GEFCO, the European leader in integrated automotive logistics, including Finished Vehicle Logistics (FVL), and a top 10 global provider of multimodal supply-chain solutions, today released its financial results for the twelve months of 2020 ending 31 December 2020.

Luc Nadal, Chairman of the Management Board of GEFCO, commented:

Luc Nadal, Chairman of the Management Board of GEFCO, commented:

“I am proud of GEFCO’s 2020 results which demonstrate resilience despite the negative impact of the COVID pandemic on our business especially in the first half of the year. As an agile, asset-light business, we were able to control costs while going the extra mile to meet our customers’ needs. Our revenues declined in April, May, and June at the height of major global disruptions in global business, but during the second half of 2020 we were able to increase our activities in line with our customers’ production ramp-up schedules. Given GEFCO’s extensive portfolio of automotive and industrial customers, we are pleased with our ability to maintain a robust operating margin in this difficult context.

I would like to sincerely thank our customers and partners for their commitment and trust in 2020. Working in a spirit of cooperation and understanding, we continued to help automotive customers find solutions to keep their supply chains moving, including our historical client Groupe PSA. For non-automotive customers, we pursued diversification and adapted our multimodal logistic solutions to meet their changing needs. Our time-critical solutions by air and road were in high demand among customers in the healthcare, consumer goods and electronics industries, and we were able to rise to their challenges. Our employees kept our Partners, unlimited promise and delivered incredible work and commitment in 2020. We implemented new health and safety measures and adapted our processes to meet our customers’ additional requirements seamlessly and in record time. In 2021, we will continue to focus on providing best-in-class supply-chain solutions with a strong focus on the health and safety of our employees around the world.”

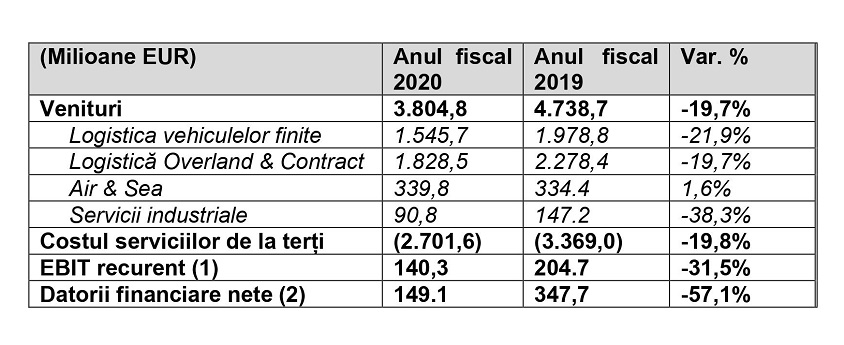

(1) Recurring EBIT is measured before non-recurring operating income and expenses.

(2) Net financial debt corresponds to financial debt net of cash and cash equivalents. Financial debt is the sum of bank borrowing, lease liabilities (IFRS 16 & IAS 17), derivative instruments, employee profit-sharing fund, guarantees and other borrowing, but excludes debt on minority interest acquisitions. Excluding lease liabilities, net financial debt turned into net financial cash amounted to €158.9 million as of 31 December 2020.

Pavel Ilichev, Executive Vice President, Finance & Strategy, commented:

“I am pleased with GEFCO’s robust financial management in 2020. We experienced a 19.7% decrease in revenues due to disruptions in our customers’ businesses around the world but maintained a significant 3.7% operating margin, vs. 4.3% in 2019. When the crisis began in March with no end in sight, we took measures to limit the financial impacts by reinforcing strict financial controls throughout the organization. Moreover, our asset-light business model continued to offer elasticity in fixed and variable costs, and we benefited from government support to safeguard employment in a number of countries.

GEFCO’s unprecedented positive free cash flow strengthened our liquidity position, and we had no requirement to seek additional funding. We focused on strategic initiatives with selective CAPEX and invested in electric vehicle charging stations at many of our compounds to support the electrification of the automotive industry. GEFCO’s strong ability to generate cash and our current low leverage ratio allows us to resist headwinds and economic uncertainties, and we are well placed for the year ahead and the associated economic recovery.”

GEFCO Group generated revenues of €3.8 billion during FY 2020, a 19.7% decrease on the same period in 2019 (-17.3% lfl). The results per division are as follows:

• The Finished Vehicle Logistics (FVL) division performed in line with the automotive industry (22% decrease in European automotive production as reported by IHS Markit). Revenues amounted to €1,545.7m (-21.9% reported and -20.5% lfl), down €454.0m versus 2019 mainly during Q2 2020. Q4 2020 was at par compared to Q4 2019. The FVL division demonstrated its sector-leading expertise by successfully managing the temporary closure of customer car factories and underlying logistics flows under unprecedented constraints.

• The Overland and Contract Logistics (OVL & CL) division was less impacted than FVL due to diversified customer portfolio. Revenues decreased 19.7% to €1,828.5m (-18.1% lfl). OVL & CL delivered more time-critical solutions by road and helped customers ensure inventory readiness in the context of resumed production.

• The Air & Sea (A&S) division experienced strong demand for time-critical solutions by air to distribute essential medical supplies and personal protection equipments from Asia to Europe and North America. Revenues rose to €339.8m, an increase of +1.6% vs. the same period in 2019 (+4.9% lfl).

• The Industrial Services (IS) division reported revenues of €90.8m, down 38.3% (-12.2% lfl). Light assembly operations were transferred to Groupe PSA on 31 December 2019, which explains this drop.

A healthy financial position fueled by significant operating profitability and strict working capital management

Despite the health crisis and lockdowns during H1 2020, GEFCO Group delivered significant recurring EBIT of €140.3m with a margin of 3.7%, decreasing only by 60 bps compared to 2019. This solid recurring EBIT was driven by:

• Strong cost control at every level and associated savings

• A €667.4m reduction in cost of third-party service, highlighting the relevance of our asset-light business model

• Business recovery during Q3 and Q4 2020, the latter being the strongest Q4 in GEFCO’s history in terms of operating profit

On top of operating profitability, GEFCO exercised strict working capital management and selective CAPEX, which boosted cash generation and led to a record high in cash flow, close to €285m (+€70m vs. 2019).

As of 31 December 2020, GEFCO Group’s net financial debt benefitted from these decisions, which produced ample liquidity headroom, leading to an unprecedented low in net debt, below €150m, compared to €347.7m on 31 December 2019.

Strategic investments in electric vehicle (EV) logistics and solutions for in-life vehicle management with Moveecar

The mobility landscape is changing with a steady increase in consumer demand, environmental regulation and government schemes to support electric vehicle (EV) sales. The market share for electric vehicles is expected to reach 26% as soon as 2026 and supply chains will need to adapt to manage both combustion and EV powertrains concurrently. With its expertise in complex supply chain solutions, GEFCO is partnering with EV manufacturers and retailers to support their transformation with compliant, innovative, agile and scalable solutions that include inbound, outbound, aftermarket and end-of-life battery management. For example, GEFCO is equipping all its compounds with charging stations to manage increased demand for finished EV logistics. In the UK GEFCO began working with electric car subscription service Onto to provide smart repair services and delivery to and from our four Finished Vehicle Logistics (FVL) compounds. The Group is also working with LEVC to provide EV conversions and deliveries to prospective fleet clients.

From a car’s first registration to the end of its life, Moveecar is a GEFCO Group brand that offers a wide range of on-demand services for mobility players (car manufacturers, retailers, leasing companies, auctioneers, etc.). Moveecar’s integrated services are designed for single or multiple requirements, including storage, repair, transport and appraisals, as well as concierge and administrative services. Leveraging GEFCO’s expertise and professional partner networks, Moveecar’s solutions are available via a dynamic plug-and-play digital platform. Currently several mobility players are using Moveecar’s digital platform for a variety of services, including vehicle deliveries direct from compounds to final customers, and used-car storage and refurbishment. For example, in Shanghai GEFCO is partnering with Polestar, Volvo’s EV brand for individual car deliveries.

Market Clients portfolio boosted by customer contract extensions and new business

GEFCO continued to leverage its leadership in automotive logistics while successfully diversifying in the industrial, consumer products and life science sectors. For example, the Group expanded its workshop activity to equip 10,000 delivery vans for a customer serving the world’s leading e-commerce retailer. In 2020, Market Clients (customers excluding historical Groupe PSA) represented 50% of total revenues.

In Finished Vehicle Logistics, Skoda signed a five-year partnership with GEFCO for the storage and distribution of vehicles to its Slovakian dealership network. The Group also renewed its agreement to distribute Toyota and Lexus vehicles in the Czech Republic, Slovakia, Hungary and Russia. In France, Ford signed a partnership with GEFCO to distribute 40,000 new vehicles annually, building on an already strong partnership with Ford in Europe. GEFCO also expanded its activities for Renault Nissan Dacia in Spain and signed a partnership with truck manufacturer MAN to export finished vehicles from Europe to the rest of the world by sea.

In Overland and Contract Logistics, GEFCO was awarded a contract with Yazaki, the world’s largest producer of automotive wiring harnesses, to supply components from Bulgaria and the Baltics to the Czech Republic. Electrolux renewed its confidence in GEFCO for distributing products from assembly plants in Poland, Turkey, Ukraine and Romania. Nestlé entrusted GEFCO with the distribution of water, coffee, pet care and healthcare products throughout Greece, Poland, Switzerland, France, Turkey, Portugal and Serbia. In addition, Knauf, a specialist in insulation materials for building construction, partnered with GEFCO to move materials in France and Belgium. In the UK, GEFCO was awarded a long-term contract with a leading US multinational specializing in science-based technologies to support their operations.

In Reusable Packaging, Jaguar Land Rover extended its contract with GEFCO in the UK until 2021. In addition, GEFCO signed several new contracts with top brands for integrated logistics services. For example, GEFCO was awarded contracts to import and store motorcycles in Mexico for two well-known brands, Royal Enfield and Zontes.

In Industrial Services, global commercial vehicle manufacturer Foton Motors signed a partnership with GEFCO in Brazil to assemble utility vehicles.

In Air & Sea, GEFCO partnered with a leading global Life Sciences & Healthcare Group to launch their first long-term sea freight initiative. With GEFCO’s expertise, certifications and long-standing partnership with the customer, the Group shipped over 15,000 twenty-foot equivalent units (TEUs) of medical supplies globally.