More than half of the 175,000 self-checkout units shipped globally last year were cashless, as COVID-19 encouraged retailers to invest in solutions to reduce contact between customers and staff

Surge in activity at pan-European and domestic grocery chains

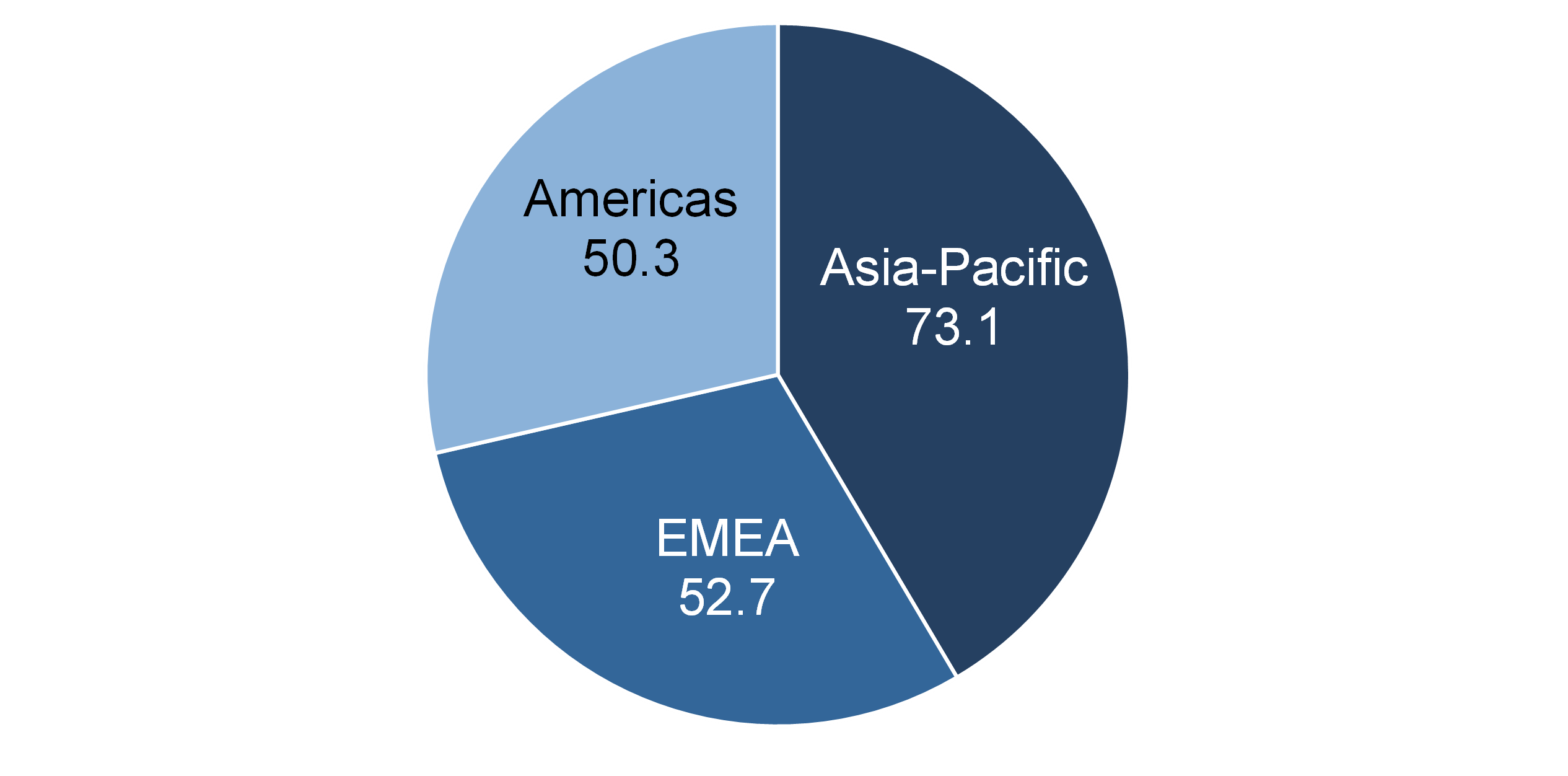

2020 saw another record year of investment in self-checkout technology, with shipments increasing by 25% globally, according to Global EPOS and Self-Checkout 2021, a new study by strategic research and consulting firm RBR. The COVID-19 pandemic further accelerated retailers’ investment in self-service solutions, helping reduce close interaction between customers and store associates.

Across Europe, there was a surge in activity with retailers rolling out units across their store networks. Grocery chains including Carrefour, Lidl and Kaufland continue to invest heavily in the technology, installing machines across the continent. Likewise, domestic supermarket banners including Russia’s Pyaterochka and Poland’s Biedronka ramped up their self-checkout rollouts.

Self-checkout penetrates new sectors in North America, while cashless boosts Asia

Mainstream grocers in North America continue to expand self-checkout offerings, but the technology is also increasingly offered by other types of retailers, including discounters, convenience stores and pharmacy chains. Major firms rolling out terminals include variety store chain Dollarama in Canada and CVS drugstores in the USA.

The research shows that, increasingly, retailers are installing cashless self-checkout terminals, which represented 55% of global shipments last year. Asia-Pacific has the highest penetration of non-cash units, and saw activity jump by a third, boosted by China’s leading retail groups such as Suning and CR Vanguard rolling out self-checkout terminals to more locations.

In well-established markets, such as Australia, retailers are replacing previous generation cash units with compact card-only machines, while in cash-heavy Japan major convenience store chains continue to adopt full self-checkout solutions.

Self-checkout investment in under-developed markets set to continue

Self-checkout momentum also picked up in several major retail markets where adoption had been weaker, and 2020 saw the first-ever pilot of the technology in the Philippines.

Alan Burt, who led the research, commented: “With new projects starting in Brazil, Mexico and South Korea, as well as in smaller countries, RBR expects self-checkout penetration to continue to grow, with installations forecast to surpass 1.5 million by 2026”.