New research from RBR highlights growing collaboration worldwide between major retailers and vendors to open stores with checkout-free technology

More than 32,000 stores allow customers to skip scanning at checkout

Retailers are seeking to reduce friction and provide customers with a quick, easy and personalised shopping experience. Mobile Self-Scanning and Checkout-Free 2021, a brand-new study by strategic research and consulting firm RBR shows 32,500 stores worldwide allowing customers to avoid the end-of-shop scanning process.

The study reveals a competitive market home to a diverse range of more than 60 hardware and software suppliers, from global technology giants to growing start-ups.

Retailers source a wide range of self-scanning solutions or build their own

Hundreds of retailers across the world now offer customers the chance to scan items as they move around the store. They provide dedicated handheld devices or apps for consumer smartphones, with many major chains developing the software themselves.

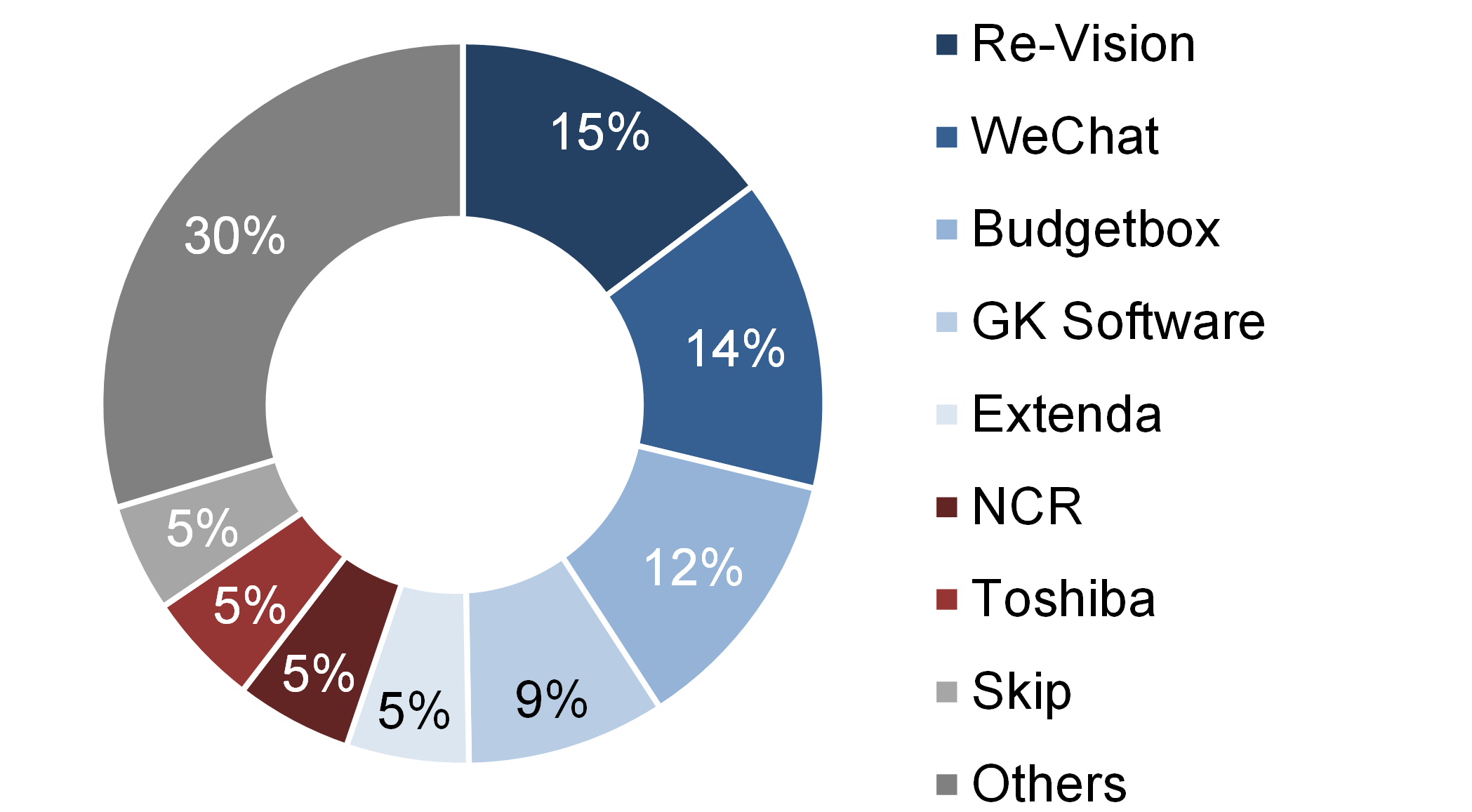

Most retailers work with third-party vendors including specialists in mobile self-scanning. Netherlands-based Re-Vision works mainly with European supermarket chains, while French firm Budgetbox supplies the country’s major grocery banners. Other retailers are collaborating with the supplier of their POS software; GK Software, Extenda, NCR and Toshiba all have a significant market presence.

A range of start-ups and other tech firms also supply mobile self-scanning solutions, including US provider Skip which works mainly with grocery and fuel convenience retailers, and the UK’s Mishipay, which has partnered with several non-food customers, including sports goods firm Decathlon. In China, meanwhile, the largest retailers use “mini-programmes” for self-scanning supplied by Tencent’s WeChat within its own application.

Suppliers’ shares of mobile self-scanning software, by stores, 2020

Zebra leads for retailer-provided devices

Mobile Self-Scanning and Checkout-Free 2021 shows that the market for retailer-provided hardware devices is far more concentrated; US firm Zebra is the largest supplier globally with more than half a million units live, while Italy’s Datalogic accounts for most of the remainder and leads in its home country.

Retailers and technology firms partner to refine checkout-free solutions

Amazon has more checkout-free stores than any other retailer and has also deployed its ‘Just Walk Out’ technology at other firms’ stores. Innovative checkout-free projects are popping up across the world, from ‘grab and go’ stores using a combination of cameras and other sensors to capture shoppers’ product selections, to ‘smart cart’ solutions which can automatically recognise items placed within them.

Collaboration is key as retailers and vendors look to scale these solutions in the real world. Grocery chains Carrefour and Lawson are working with US firms AiFi and Zippin respectively on checkout-free stores, while Tesco is piloting the technology in partnership with Israel’s Trigo. Meanwhile, Canadian retailer Sobey’s is piloting a ‘smart cart’ solution provided by Caper.

Alan Burt, who led RBR’s Mobile Self-Scanning and Checkout-Free 2021 research, commented: “The market is developing rapidly, with retailers partnering with innovative tech firms to create more new and exciting store concepts in order to reduce friction from their customers’ shopping experiences”.