Six vendors supplied more than 10,000 terminals each in 2020, as shipments reached a new record high of 175,000 globally

Fierce competition between self-checkout vendors as market hots up

Momentum in the self-checkout revolution kept up in 2020, with shipments booming by 25% globally, according to Global EPOS and Self-Checkout 2021, a new study by strategic research and consulting firm RBR.

The research reveals a dynamic and competitive market, with more than 20 vendors present, ranging from international suppliers to local players, as well as some retailers building their own solutions.

NCR and Toshiba account for nearly half the market…

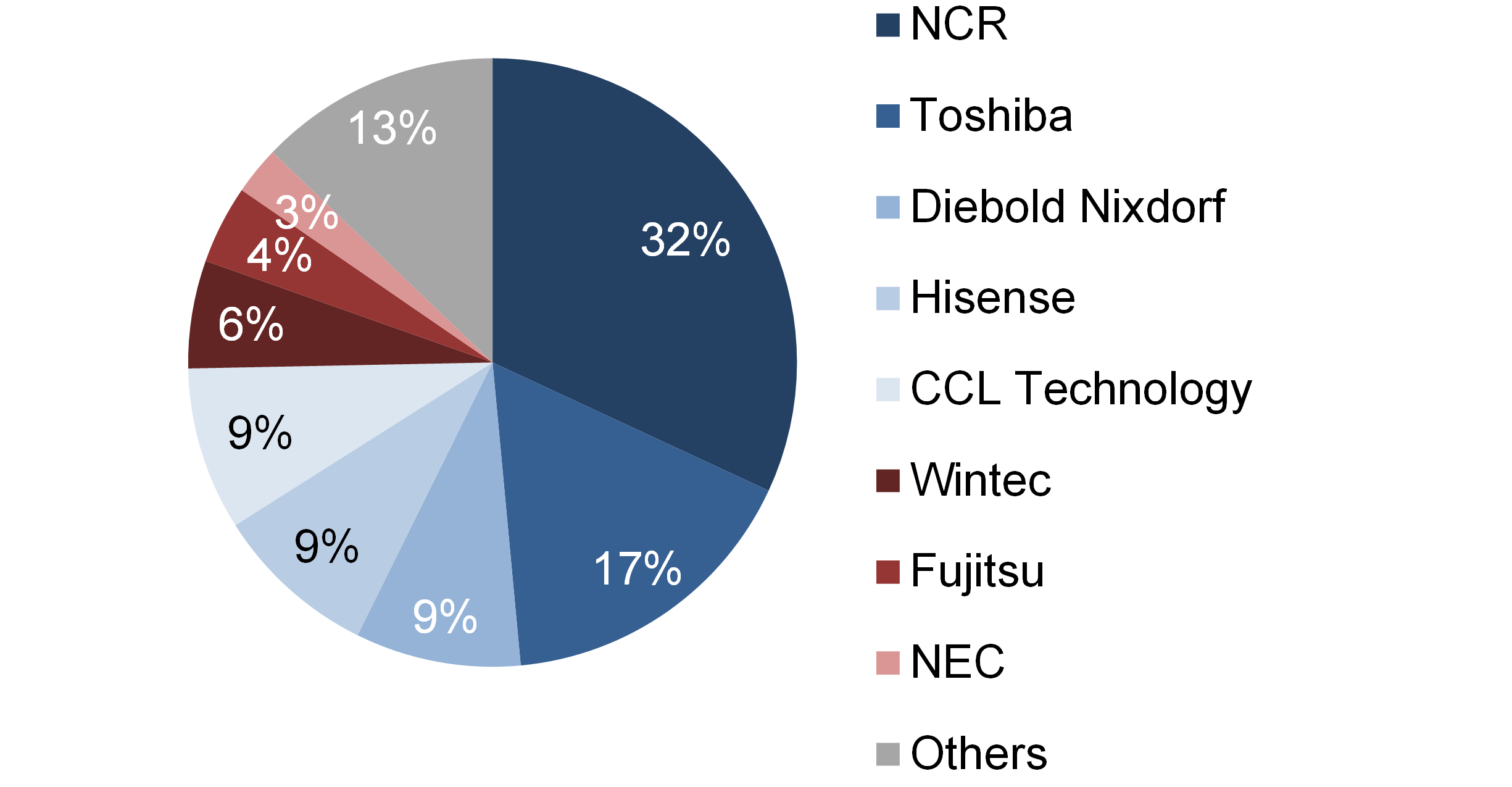

NCR is the world’s largest self-checkout supplier, accounting for a third of shipments in 2020. It delivered more than 55,000 terminals for the second consecutive year, working with major retailers worldwide including Walmart across various countries, UK supermarket chains Sainsbury’s and ASDA, and Australian grocery giant Woolworths.

Toshiba has the second largest share and delivered more self-checkout terminals to the USA than ever before. It also leads in its home market of Japan, where it supplies the country’s largest convenience store operators, 7-Eleven and Family Mart, as they roll out the technology.

…but the combined share of other vendors increases strongly

Diebold Nixdorf grew its share of the self-checkout market by two percentage points, with shipments up by more than 70%. Its international customers include discount grocery chain Lidl and global home furnishings firm IKEA.

The report shows that Chinese vendors Hisense, CCL Technology and Wintec all delivered more units in 2020. While most of their customers are based in their home market, all three have expanded overseas, with projects in countries such as Ukraine and Poland.

Likewise, Japanese firms Fujitsu and NEC also expanded their self-checkout activity, working with retailers in North America and Japan respectively.

Suppliers’ Shares of Self-Checkout Shipments Worldwide, 2020

Some major retailers build their own self-checkouts

Several large retailers have opted to build their own self-checkout solutions, including US firms Home Depot and Dollar General, as well as Russia’s X5 Group. These chains operate more than 35,000 stores between them and are rolling out in-house self-checkout technology across their networks.

With healthy competition between vendors and some retailers creating their own solutions, RBR forecasts that global self-checkout installations will exceed 1.5 million by 2026. Alan Burt, who led the research, commented: “As retailers across the world continue to embrace self-checkout technology, they are looking to find the solution which best fits their business needs and customer expectations, providing huge opportunities for suppliers”.