The number of stores offering a ‘grab and go’ experience grew by more than 60% in 2022, as major grocery retailers continued pilots and convenience chains opened further locations

Over 700 stores worldwide offer a frictionless shopping experience

Retailers around the world are investing in checkout-free stores, where customers enter, pick up items and leave, tracked by a combination of computer vision, artificial intelligence, scales and sensors. During 2022, an additional 300 such outlets opened to the public, according to Mobile Self-Scanning and Checkout-Free 2023, a brand-new study from strategic research and consulting firm RBR.

Although the majority have been opened in China and the USA, checkout-free stores are now live in a an ever-increasing number of countries, as diverse as Lithuania, Oman, Portugal and South Korea.

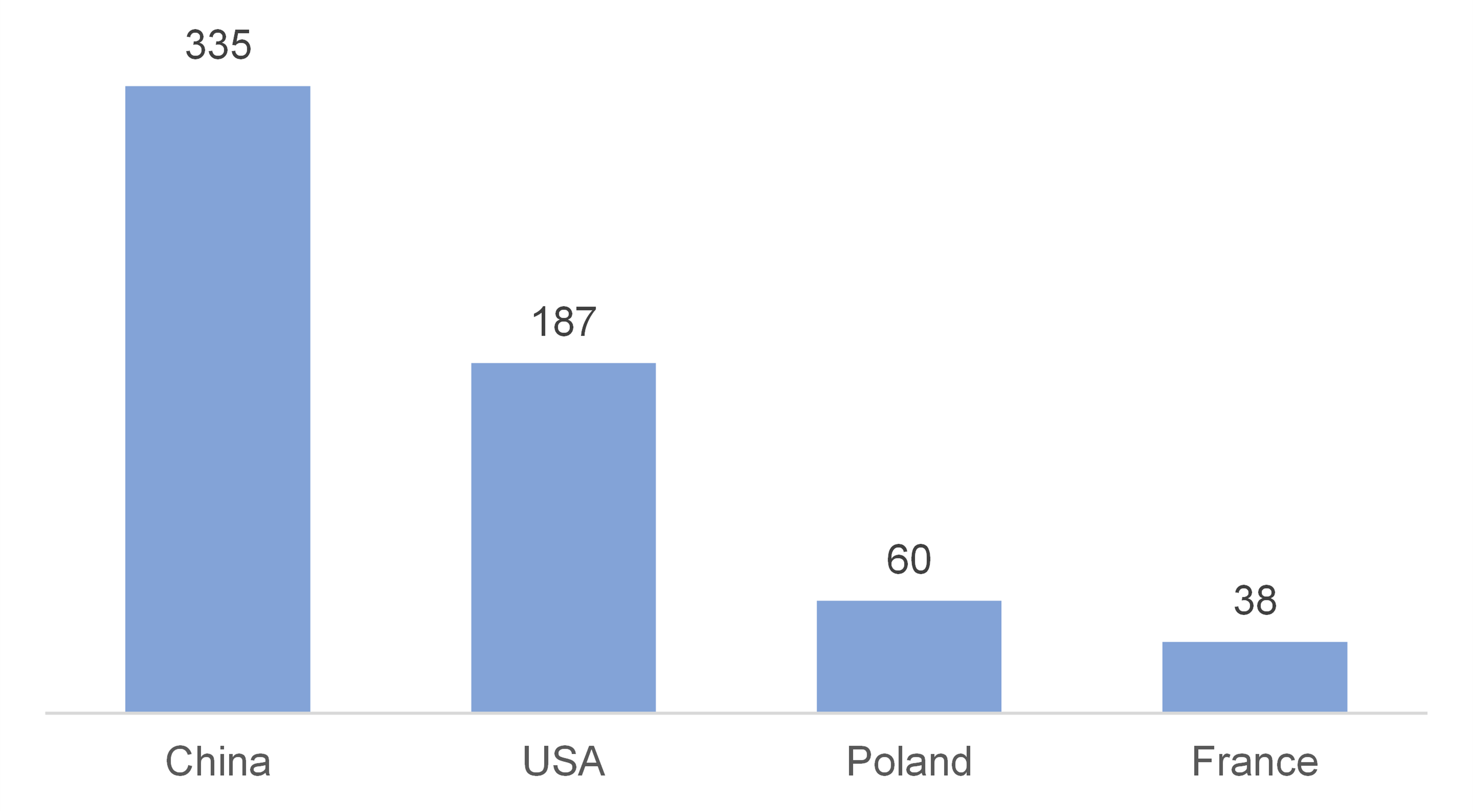

Largest checkout-free markets, by stores, 2022

Major grocery retailers are trialling checkout-free technology

The study shows that so far, the technology has mainly been rolled out at small-format stores – this includes Polish convenience retailer Żabka, which operates around 60 checkout-free ‘Nano’ outlets. Other convenience operators to open multiple ‘grab and go’ locations include Family Mart and Circle K.

Major supermarket chains including Aldi, Carrefour, REWE and Tesco have opened at least one checkout-free store, and in some cases, several. Some offer the solution as part of ‘hybrid’ stores, which also give customers the option of using self-checkout terminals or assisted lanes instead.

Transport hubs and sports stadia prove common locations for checkout-free stores

Stores offering a ‘grab and go’ experience are often located in areas of high footfall. For example, checkout free stores located in airports have been opened by travel retail operators including Hudson and Paradies Lagardère. In the USA, several stores have been installed in sports stadia, including at the homes of the Denver Broncos and the Tennessee Titans.

Four providers account for the vast majority of stores

RBR research shows a vibrant competitive landscape, with four vendors of check-out free technology together accounting for more than 85% of checkout-free stores globally. More than 300 stores in China use technology from domestic firm Cloudpick, which also works with retailers in other parts of Asia. Amazon is the largest provider in the USA with own-branded stores, as well as supplying its ‘Just Walk Out’ platform to other retailers including Hudson, Sainsbury’s and WHSmith.

US vendor Zippin has a strong presence in its home market, with its frictionless solution used across a range of sports stadia. California-based AiFi has the largest number of checkout-free stores in Europe, working with Żabka in Poland as well as firms in other countries. A range of other suppliers are present, including French startup Boxy (formerly Storelift), which has a network of micro format stores, Israel’s Trigo, Japan’s Touch To Go and US firm Grabango.

Growth in checkout-free stores expected to ramp up further

RBR forecasts that by the end of 2028 the number of checkout-free stores globally will grow to more than 5,000. Major chains, which are increasingly trialling the technology, are likely to roll out more outlets across their store networks as they look to mitigate high labour costs and offer more convenience.

Alex Maple, who led RBR’s Mobile Self-Scanning and Checkout-Free 2023 research, commented: “In areas of high footfall where customers value convenience, the potential for checkout-free stores is considerable. As costs and implementation become more manageable, increasing numbers of retailers will invest in this technology, aiming to provide customers with a truly frictionless shopping experience”.